Transform Your Gold into Instant Capital

Need fast access to funds? Our gold loans provide a seamless way to leverage the value of your gold jewelry or bullion. Turn your gold into immediate cash with our hassle-free gold loan solutions. Whether you need funds for personal needs, business expenses, or unexpected emergencies, our gold loans offer a quick and secure way to access the value of your precious assets. Enjoy competitive interest rates, flexible repayment options, and a straightforward application process.With minimal paperwork, quick approvals, and attractive terms, you can get the cash you need without selling your assets. Trust us to provide a convenient and reliable solution to meet your financial needs.

Features

Eligibilty

Documents

EMI Calculator

Charges

FAQs

Features and Benefits of our Gold Loan

Loan in just 15 minutes

Apply with PAN or Aadhaar Card

Loans starting from Rs.5,000

Multiple repayment options

Explore our Personal Loan Solutions

- Secured Loan: Backed by gold collateral.

- Quick Processing: Fast approval and disbursement.

- Flexible Loan Amount : Based on pledged gold value.

- Instant Liquidity: Access funds quickly without selling gold.

- Lower Interest Rates: Secured nature leads to competitive rates.

- Versatile Use: No restrictions on how loan funds are used.

Eligibility Criteria

- Age: Typically, borrowers should be 18 years or older.

- Ownership: You must own the gold being pledged.

- Gold Quality: The gold should meet the lender’s purity standards.

- Identification: Valid government-issued ID for identity verification.

Documents Required to Apply for Gold Loan

- Identity and signature proof

- Voter ID

- Passport

- Aadhaar Card

- Driving License

- PAN Card

- Employee Identity Card (in case of government employees)

- Address Proof

- Rent Agreement

- Bank Statement

- Voter ID Card

- Passport

- Driving License

- Telephone/Electricity/Water/Credit Card bill or Property tax.

- Two post-dated cheques for security purposes

- Passport-size photographs

Gold Loan EMI Calculator

Gold Loan EMI (Equated Monthly Installment) is calculated using the following Compound Interest formula:

EMI = [P * r * (1 + r)^n] / [(1 + r)^n – 1]

Where:

EMI = Equated Monthly Installment

P = Gold Loan principal amount

r = Monthly interest rate (Annual interest rate divided by 12, expressed as a decimal)

n = Gold Loan tenure in months

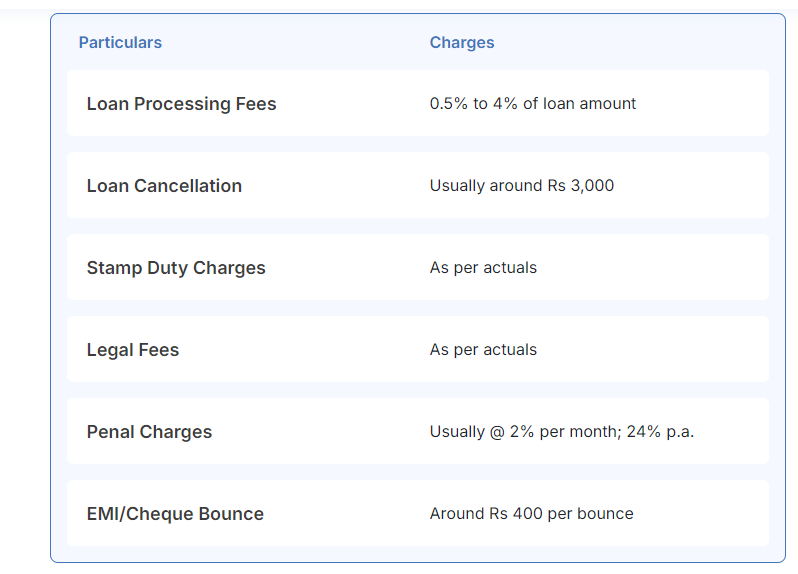

Fees and Charges for Gold Loan

The fees and charges of gold loans usually vary from lender to lender and from case to case. The aforementioned table will give you a fair idea of the fees and charges related to gold loans.Other fees and charges that lenders may levy on your personal loan include documentation charges, verification charges, duplicate statement charges, NOC certificate charges and swap.

FAQs

The maximum loan amount you can get for a gold loan depends on several factors, including the purity and weight of the gold provided as collateral, the lender’s policies, and the prevailing market value of gold. Typically, lenders offer loans ranging from 60% to 80% of the value of the gold ornaments pledged as collateral. However, the actual loan amount offered to you will depend on the specific terms and conditions of the lender.

The repayment period for a gold loan is typically short-term, ranging from a few months to a few years, depending on the lender and the loan amount. Some lenders offer flexible repayment options, allowing borrowers to repay the loan in EMIs or as a lump sum at the end of the loan term. It’s important to check with the lender for the specific repayment terms and options available for the gold loan.

If you can’t repay a gold loan, the lender may auction off the gold ornaments pledged as collateral to recover the outstanding loan amount. It’s important to communicate with the lender and explore repayment options to avoid losing your gold.

Yes, the gold pledged as collateral for a gold loan is generally safe with the lender. Lenders are required to follow strict guidelines for the safekeeping of the gold, including secure storage facilities and insurance coverage. Additionally, borrowers receive a receipt for the gold pledged, detailing the quantity and quality of the gold. It’s important to choose a reputable lender to ensure the safety of your gold.

The time taken to get approval for a gold loan can vary depending on the lender and their internal processes. However, in general, gold loans are known for their quick disbursal process, and approval can often be obtained within a few hours. Some lenders may even offer instant approval for gold loans, especially for smaller loan amounts. It’s advisable to check with the lender for their specific timeline for approval and disbursal of the loan amount.

Yes, if you need to extend the repayment period of your gold loan, most lenders offer options to renew or extend the loan. This typically involves paying the interest due up to that point. However, the specific terms and conditions for extending the loan, such as the maximum extension period and any additional fees, may vary depending on the lender. It’s advisable to check with your lender regarding their policies for extending the repayment period of your gold loan.

During a gold loan application, the lender evaluates the purity and weight of the gold jewelry or ornaments you wish to pledge as collateral. This involves testing the purity, weighing the gold, and calculating the maximum loan amount you are eligible for based on the value of the gold. Once agreed upon, you sign the loan agreement, and the loan amount is disbursed to you.