Use Our Convenient Business Loan Solution to Reach Your Objectives!

At NOBO, we understand that each business has its own unique journey. Our business loans offer customized solutions to fit your specific needs, from managing cash flow to funding growth initiatives.Simplify your path to financial success with our business loans. We offer quick approvals, competitive rates, and a variety of loan options to support your growth strategy. Partner with us to access the funds you need, when you need them, and watch your business thrive.

Features

Eligibility

Documents

EMI Calculator

Charges

FAQs

Get high Business Loan Eligibility

Make sure you have all the necessary paperwork together, know your credit score, decide how much money you need, research your possibilities for business loans, and write up a business plan before you apply for the loan.

Common Documents Required

Proof of address & photo identity proof of the promoters, business proof, income proof, partnership deed for partnership firm, articles of association, memorandum of association, board resolution, PAN card, etc.

Criteria for Business Loan Approval

Applicants should be aged between 21 to 65 years, having business vintage of a minimum of 1-2 years. The minimum business turnover and a minimum annual turnover as per the ITR will be required. The business should be profit-making for at least the last 1 year.

Features and Benefits of our Business Loans

- Term Loans

- Working Capital Loans

- Business Expansion Loans

- Equipment Financing Loans

- Invoice Financing & Bill Discounting

- Machinery Loans

Eligibility Criteria & Eligible Entities

Business Type: Most lenders provide loans to various types of businesses, including sole proprietorships, partnerships, limited liability companies (LLCs), corporations, and more.

Credit Score: A good credit score is often required to qualify for a business loan. Lenders use your credit history to assess your ability to repay the loan.

Business Age: Some lenders require a minimum operational history for your business, usually ranging from a few months to a year or more.

Annual Revenue: Lenders may have a minimum annual revenue requirement to ensure your business has a stable income.

Collateral: Secured loans might require assets as collateral to secure the loan. Collateral can be real estate, equipment, inventory, or other valuable assets.

Cash Flow: Lenders often evaluate your business’s cash flow to determine your ability to repay the loan.

Age Criteria: Min. 21 years at the time of loan application & Max. 65 years at the time of loan maturity.

Eligible Entities: Individuals, MSMEs, Sole Proprietorships, Partnership Firms, Public and Private Limited Companies, Limited Liability Partnerships, retailers, traders, manufacturers, and other non-farm income-generating business entities engaged only in the services, trading, and manufacturing sectors

Business Vintage : Min. 1 year or above

Business experience: Min. 1 year, business location to remain same

Annual Turnover: Shall be defined by the Bank/NBFC

Credit Score: 700 or above (Preferred by most private and public sector banks)

Nationality: Indian citizens

Additional Criteria: Applicants must own either a residence, office, shop, or Godown.

Documentation for Business Loans

The list of documents required for a business loan to be submitted varies based on type of business entity. Submit the following documents to begin with the loan process:

- ITR for the past 2-3 years

- Current Bank Account Statement for the last 12 months

- Photocopy of PAN Card

- Address Proof for Residence such as Voter Card, Passport, Aadhaar Card, Telephone Bill, Electricity Bill

- Address proof for Business such as the Telephone Bill or Electricity Bill

- Last Financial Year’s provisional Financials and future year’s projections.

- Company’s business profile on the letterhead

- 2 photographs of promoters and property owners.

- Sanction letter and Repayment schedule of existing loan

- GST registration certificate and GST returns of latest 2 years.

- D-Vat/Sale tax registration copy

- Udhayam Aadhaar registration certificate

- Rent agreement copy of factory and residence (if property is rented)

- Business Continuity proof of 3 years (3 years old ITR/Company registration etc)

- Company PAN Card, Certificate of Incorporation, MOA, AOA, List of Directors, and Shareholding pattern for Pvt Ltd companies

- Partnership Deed, Company pan Card for Partnership Companies

How to use Business Loan EMI Calculator

Using a business loan EMI (Equated Monthly Installment) calculator can help you estimate your monthly loan repayment amount.

Follow these steps to use a business loan EMI calculator effectively:

- Enter loan amount, interest rate, tenure.

- Click Calculate.

- View EMI, total interest, repayment.

- Adjust tenure if needed.

- Consider extra costs.

- Check budget compatibility.

- Confirm with the lender before finalizing.

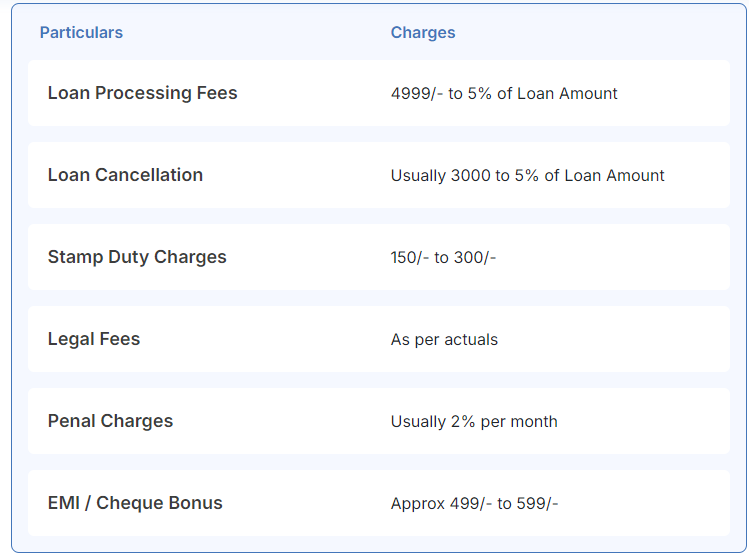

Fees and Charges for Business Loan

The fees and charges of business loans usually vary from lender to lender and from case to case. The aforementioned table will give you a fair idea of the fees and charges related to business loans. Other fees and charges that lenders may levy on your business loan include documentation charges, verification charges, duplicate statement charges, NOC certificate charges and swap.

Business Loan FAQs

Business loans are available to various entities, including sole proprietorships, partnerships, LLCs, corporations, non-profit organizations, and startups. Eligibility is typically based on factors like the business’s creditworthiness, revenue, profitability, and the borrower’s personal credit history. Each lender may have specific criteria, so it’s advisable to check with them for exact requirements. The amount one can borrow depends on several factors, including the lender’s policies, the borrower’s creditworthiness, the purpose of the loan, and the financial health of the business. Typically, business loans can range from a few thousands to several Lakhs. Lenders assess the borrower’s ability to repay the loan based on factors such as credit score, business revenue, and profitability.

Udyam Registration, or MSME Registration, is a special card granted to small and medium-sized businesses by the government of India. This card has a unique number and a certificate stating that the company is a micro, small, or medium enterprise. This Udyam registration helps MSMEs secure loans with lower interest rates, reduced collateral requirements, and faster processing times, making it easier for small businesses to grow and thrive.

By registering under Udyam, businesses can also gain access to government subsidies, tax benefits, and other financial support tailored to their needs. This initiative is part of the government’s broader effort to promote entrepreneurship and support the growth of MSMEs in India.

Minimum Cibil score required for acquiring a business loan is generally 650+ but it also depends on various lenders.

To qualify for an instant business loan, you typically need a good credit score, stable revenue, and a low debt-to-income ratio. Lenders may also require your business to have been operational for a certain period. Meeting these criteria increases your chances of qualifying for an instant business loan, which can provide quick access to funds for your business needs.

The Government of India has initiated several loan schemes to support various sectors and promote entrepreneurship and economic development. Some key loan schemes include:

1) Pradhan Mantri Mudra Yojana (PMMY)

2) Stand-Up India Scheme

3) Credit Guarantee Fund Scheme for Micro and Small Enterprises (CGTMSE)

4) Startup India Scheme

5) Prime Minister’s Employment Generation Programme (PMEGP)

6) Credit Linked Capital Subsidy Scheme (CLCSS)”

7) National Rural Livelihoods Mission (NRLM)

These schemes are aimed at providing financial support and promoting entrepreneurship across various sectors of the economy.

Yes, it is possible to get a business loan with bad credit, but it can be more challenging. Some alternative lenders specialize in providing loans to businesses with less-than-perfect credit, but they may charge higher interest rates. Offering collateral or having a co-signer with good credit can also increase your chances of approval. Additionally, working on improving your credit score before applying can help you qualify for better loan terms.

Yes, you can usually pay off a business loan early, but it’s important to check your loan agreement for any prepayment penalties or fees that may apply. Some lenders charge a fee if you pay off the loan before the agreed-upon term, while others allow early repayment without penalties. If you’re considering paying off your business loan early, contact your lender to understand any potential fees and to discuss your options.